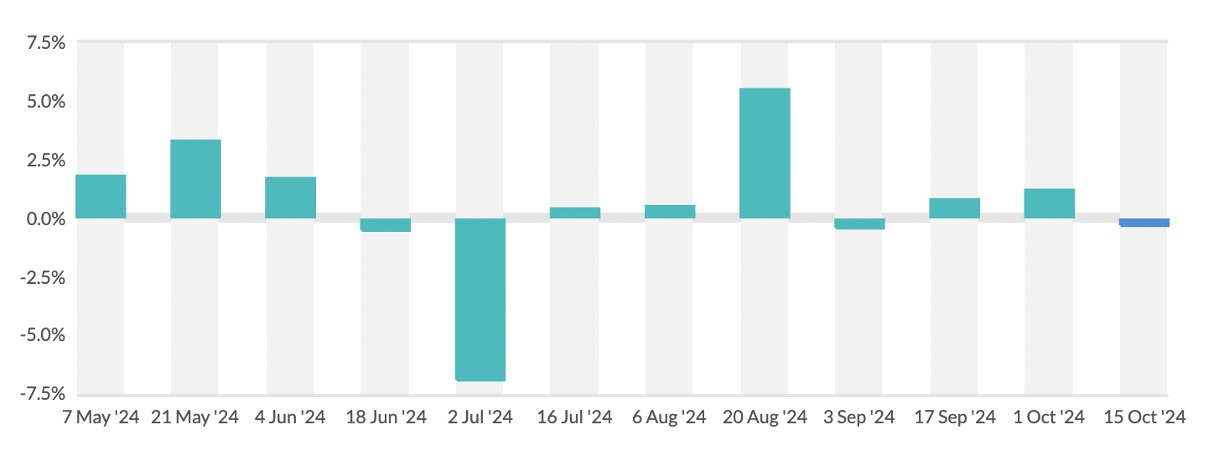

Global Dairy Trade prices are widely expected to fall during July and August following the 6.9% drop in the GDT price index in the July 2 auction, dairy industry analysts say.

A further 5% fall in whole milk powder prices, which is likely to happen in August, would lead to a downward revision in the farmgate milk price forecasts.

High Ground’s senior manager for global market insights, Stu Davison, a Kiwi working for the international dairy and grain analysts, said the trigger level for a FGMP revision would be US$3050/tonne.

WMP fell 4.3% on July 2 to finish at $3218.

From his perspective in the United States, Davison and NZ-based analysts have the track of dairy commodity prices in winter 2023 as a strong pathway predictor for this season.

WMP prices on the GDT platform fell 20% or $600/tonne between late June and mid-August in 2023, bottoming out at $2500.

Fonterra then followed the market downturn, trimming $1 from the FGMP forecast range, lowering the mid-point from $8 to $7.

A smaller, 25c reduction followed in late-August 2023 and as global market prices recovered, Fonterra lifted its forecast by 50c in October.

So how likely is the 2023 pattern to repeat?

“Fonterra’s current forecast mid-point of $8.00 won’t need to be moved until WMP prices fall under $3,050/t, which is likely to happen in August if demand remains weak,” Davison said.

NZ analysts have been forecasting milk prices higher than Fonterra but last week’s dramatic fall in the GDT, and the possibility of repeats, has caused them to rethink.

Westpac chief economist Kelly Eckhold said his $8.40 prediction was now evenly balanced with upside and downside risks.

The SGX-NZX futures market for milk prices is steady on $8.35 for this season and next season, he noted.

Futures prices for dairy commodities had been forecasting price falls before the July 2 GDT, NZX analyst Rosalind Crickett said.

Later term contracts had weaker prices because of the supply expectations surrounding New Zealand’s spring milk production.

GDT event 359 had 44% more product volume available than event 358, she said.

“So, we had the larger offer volumes along with the seasonality effects.

“From prices on the day and subsequent futures price movements our computer model of the milk price has fallen from $8.77 to $8.55.

“Farmers may be hoping that GDT 359 was a one-off, but the pattern from August 2023 suggests otherwise,” she said.

ASB senior economist Chris Tennent-Brown said one bad auction would not prompt him to reduce his $8.35 milk price forecast but three or four such large falls would prompt a revision.

“That’s where Fonterra’s wide forecast range is really appropriate at this point in the season, and I respect their conservative approach.

“While longer-term contracts for WMP remain north of $3000, Fonterra’s $8 mid-point looks reasonable.

“NZ dollar exchange rates are firmly stuck in place around US60c and €56c so that underpins dairy prices.”

Tennent-Brown said milk supply and dairy demand are in balance and the big GDT index fall was more seasonal than structural.

Davison said world milkfat markets remain short of products and prices have gone to historical highs.

Although butter and anhydrous milk fat both fell 10% last week, at US6500/t they remain near record high levels and are expected to stay above long-term averages.

Davison cited strong cream demand in Europe, a tight butter market in the US and seasonal uncertainty in NZ.

“The powders are likely to see the largest decline and that WMP will lead the way lower, but SMP prices won’t need a lot of encouragement to break lower if demand over the coming months can’t soak up excess production in NZ.

“The futures market is already pricing WMP prices to dip below $3100.

“With an increase in offer volumes on the GDT platform, compared to this time last season, along with weak demand still expected from China, the likelihood that prices keep sliding is high.”

WMP volumes to be offered on the GDT platform will increase substantially as the spring milk production peak approaches, he said.