New Zealand’s dairy industry started the 2024-25 season on a positive note, with July marking a production recovery after a slower June, though output remains on the lower side of the seasonal milk curve.

Milk production for the month reached 27.4 million kilograms of milksolids, up 9.2% year on year (YoY) – the highest July on record, surpassing the five-year rolling average by 6.2%. In tonnage terms, production totalled 310,000 tonnes, an 8.4% YoY increase, reflecting a strong early-season performance despite the initial June dip.

Peak production, typically occurring between September and November, is still ahead.

According to our revised NZX milk production predictor, YoY increases of 3.7%, 1.8%, and 0.8% are expected for August, September, and October, respectively. However, weather patterns could affect pasture growth, leading to potential volatility in production levels.

Globally, dairy markets displayed mixed trends. United States milk production in July fell by -0.4% YoY, while Argentina and Uruguay saw sharper declines of -4.8% and -9.2%, respectively. Conversely, Australia reported a 1.6% YoY increase in July production, while Europe saw 1.3% growth in June.

Upcoming US and European production reports may reveal further constraints. In the US, ongoing avian flu cases, now confirmed to be spread to California dairy cattle, and a shortage of heifers are expected to weigh on production in the coming months.

Similarly, European milk production, while recently positive, faces growing challenges, including adverse weather and disease outbreaks such as bluetongue and lungworm, which may affect output.

On the trade front, New Zealand dairy exports showed robust growth in July. Export volumes increased by 10.2% YoY, with values rising by 10.7%. Total export volumes reached 282,715 tonnes, driven by strong gains in skim milk powder (SMP), cheese, infant formula, and casein. SMP rebounded sharply, up 57% YoY, thanks to strong demand from China and other Asian markets. However, anhydrous milk fat (AMF) and butter exports saw declines in volume.

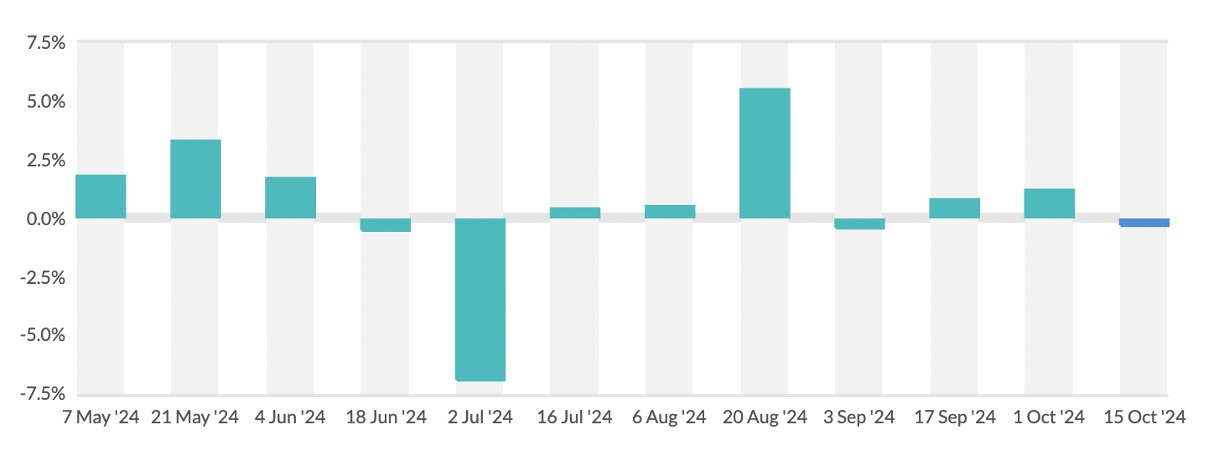

August’s Global Dairy Trade (GDT) auctions reflected this varied landscape. GDT Event 361 on August 6 saw a modest 0.5% rise in the index, driven by gains in whole milk powder (WMP) and AMF, while SMP prices continued to decline.

The market bounced back strongly later during the next August auctions, with index growth in pulse and the GDT average index surging 5.5% at Event 362 on August 20 – marking the largest increase since March 2021. September’s first auction, Event 363, saw a slight -0.4% dip, with WMP prices easing by -2.5%, while SMP showed strength, rising 4.5% reaching US$2,753 per tonne, its fourth-highest average price in the past 12 months.

As the industry navigates these developments, stakeholders are encouraged to stay informed through events like the upcoming SGX-NZX Global Dairy Seminar, scheduled for October 7-9. This annual event offers a key platform for sharing insights and strategies in response to the evolving global dairy landscape.