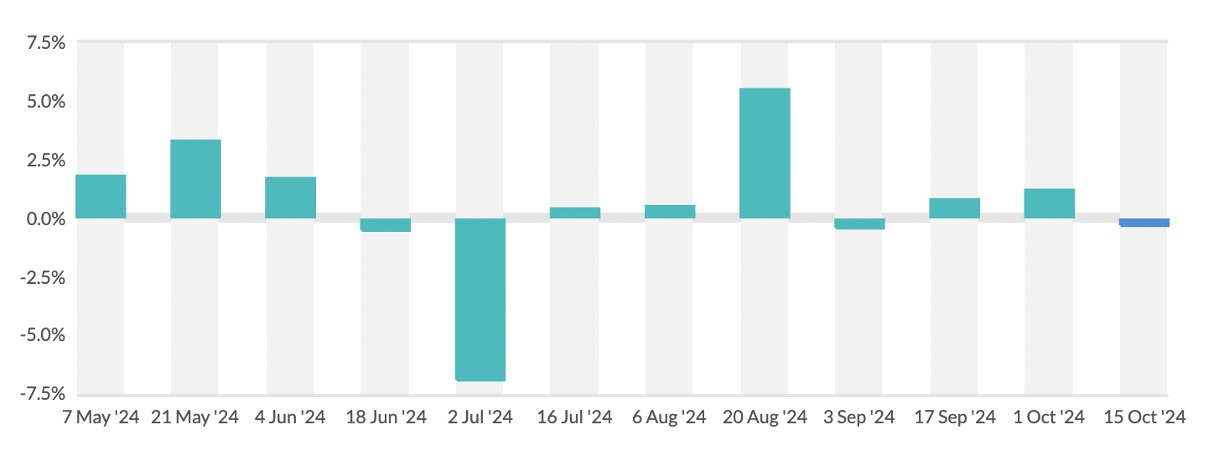

Weak Chinese demand for dairy, coupled with strong global supplies, shows no sign of improving as a number of processors cut their base price for June milk supplies.

Tirlán cut its base price to 38.08c/L, a 2c drop, with its chairman John Murphy saying: “Dairy market prices have weakened significantly in recent weeks and unfortunately this must be reflected in a reduced milk price.

“The hoped-for improvement in market sentiment does not appear to have materialised.”

Dairygold also cut its June milk price by 2c/L to 38c/L and said: “Global dairy markets have weakened significantly in the last month, and this has reduced the returns on milk.”

Carbery reduced its base milk price for June by 1c/L and is allocating 3c/L support from its Stability Fund. The cuts come as prices continued to weaken at the latest Global Dairy Trade (GDT) auction.

According to New Zealand bank ASB’s analysis of the GDT, Chinese purchases are still weak and buyers are in no rush to secure product.

It said there remains “a bit of volatility under the hood” and that “a rapid recovery in Chinese demand looks unlikely”.

“We’d need to see a substantial stimulus effort from the [New Zealand] government to lift consumer confidence. With growth slowing in most other parts of the world, there is unlikely to be much demand offset from other regions.

“On balance, we don’t expect a sharp contraction on the supply side either. Drought conditions in Europe look likely over the latter half of the year, but that comes off the back of months of excess output.”

Kerry Group, which held its base price for June milk at 37c/L, said the (global) demand for dairy has declined further, with end users well stocked, slow to call off existing orders and slow to contract new volumes.

“Milk supply is currently more than enough to cover falling demand, adding to downward price pressure,” it said in a statement.

There have been industry warnings that dairy farmer margins will be tight this year given milk price cuts and the slow rate of input price decreases.

IFA Dairy Committee Chairman Stephen Arthur said it is taking longer than anticipated for dairy markets to recover.

“This, along with very challenging weather conditions, has put significant pressure on dairy farms,” he said. “Farmgate milk has dropped by 33pc [Ornua PPI including the Ornua Value Payment, Jun 22 vs Jun 23], while the cost of our inputs have only declined by 6.7pc [CSO ag input price index, May 22 vs May 23].”

ICMSA Dairy Chairman Noel Murphy called on co-ops occupying “disappointingly low positions” in the ICMSA Milk Price Tracker to consider mid-year ‘top-up’ payments to their suppliers to help restore overall payments to “something resembling the correct levels”.

ICMSA said the 4c/L difference between top and bottom payers would be alarming in December, but “is a public disgrace” in June.

Get ahead of the day with the morning headlines at 7.30am and Fionnán Sheahan’s exclusive take on the day’s news every afternoon, with our free daily newsletter.