India’s dairy industry is expected to see healthy revenue growth of 13-14 per cent this financial year 2024-25, asserted Crisil Ratings, as strong consumer demand continues along with an improved supply of raw milk.

While the rating agency believes the demand will be supported by rising consumption of value-added products, the ample milk supply will be driven by good monsoon prospects.

A rise in raw milk supply will also lead to higher working capital requirements for dairy players. That, along with continued capital expenditure (capex) by organized dairies over the next two fiscals will result in debt levels inching up.

Nevertheless, credit profiles will be stable supported by strong balance sheets, a CRISIL Ratings analysis of 38 dairies accounting for 60 per cent of the organised segment revenue indicates so.

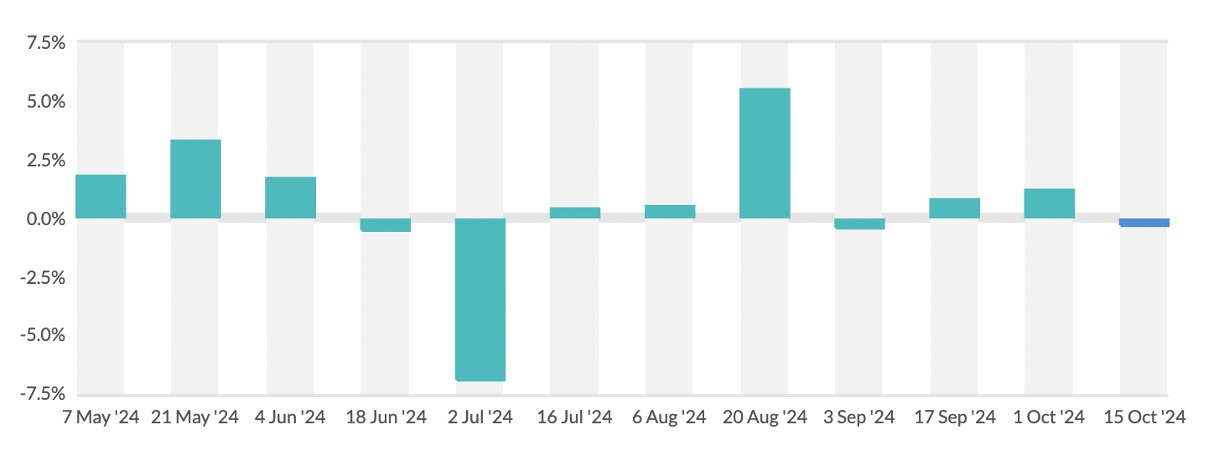

Mohit Makhija, Senior Director, CRISIL Ratings, says, “Amidst modest growth of 2-4 per cent in realization (rates), the dairy industry’s revenues are seen rising on healthy 9-11 per cent growth in volumes.”

The value-added products segment – a 40 per cent contributor to the industry revenues – is expected to be the primary driver, fueled by rising income levels and consumer transition towards branded products.

“Rising sales of value-added products and liquid milk in the hotels, restaurants and cafes (HORECA) segment will also support the revenue growth,” added Makhija.

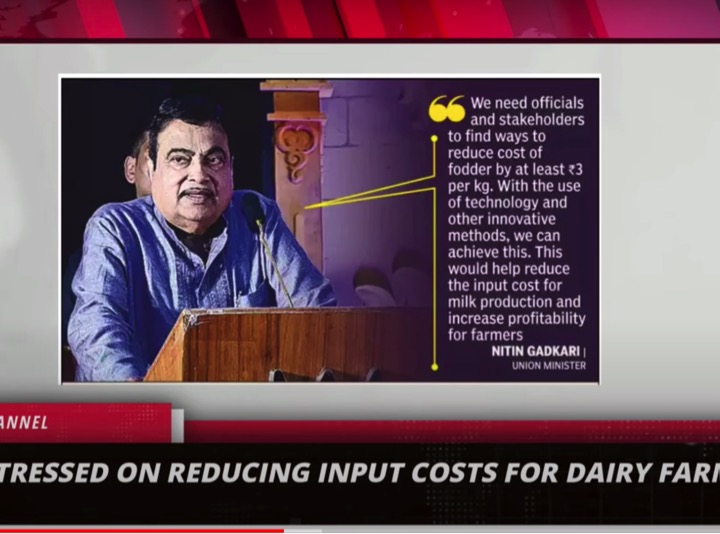

The strong consumer demand will be complemented by improved raw milk supply which is expected to increase 5 per cent this fiscal, due to better cattle fodder availability, given the favourable monsoon outlook this fiscal. Milk availability will be further supported by the normalisation of artificial insemination and vaccination processes after facing disruption in the past.

Additionally, various measures such as genetic improvement in indigenous breeds and an increase in the fertility rate of higher yield breeds will help enhance milk supply. Steady milk procurement prices augur well for the profitability of dairies, and their operating profitability is expected to improve 40 basis points (100 basis points is equal to 1 percentage point) to 6 per cent this fiscal.

Rucha Narkar, Associate Director, CRISIL Ratings, says, “While the revenue and profitability of dairies will improve this fiscal, debt levels are also expected to increase, mainly for two reasons. One, healthy milk supply during flush season will result in higher skimmed milk powder (SMP) inventory which will be consumed over the rest of the year.”

The milk powder inventory typically accounts for 75 per cent of the working capital debt of dairies.

“Two, continued milk demand will require increased debt-funded investments for new milk procurement, milk processing capacities and expanding distribution network,” Narkar added.