Milk alternatives continue to hold the largest share of all plant-based categories—15% across the total market and 41% in the natural channel—as ongoing innovations intrigue a broader group of consumers.

Despite this growth, inflation remains a challenge for plant-based milk producers. Some varieties are also being discontinued or facing pushback from dissatisfied consumers.

From supermarkets to restaurants to e-commerce outlets—and everything in between—the bottom line is clear: Consumers want more plant-based foods.

In our 2022 State of Marketplace report, PBFA shared the latest industry data covering the performance of plant-based food sales across retail and foodservice. We found that the industry hit a record $8 billion in U.S. retail sales, driven by continuous innovation and a growing variety of options. These retail gains were significant considering the marketplace landscape coming off of the pandemic, supply chain disruptions, and a rising inflationary environment. Despite challenges for our nascent industry, plant-based food brands and marketplace partners alike helped sustain consumer demand for plant-based foods, and we saw a number of newer channels like ecommerce and foodservice grow.

This year, our Marketplace Development team has continued to analyze the performance of plant-based foods across channels, uncovering unique category trends and promising areas for further expansion, releasing the findings in our Plant-Based State of the Marketplace 2023 Report. In 2023, we saw the continuing effects of inflation on shopper behavior in retail, with overall dollar expenditures increasing but purchased units of all foods decreasing. Nevertheless, grocery shoppers have continued to seek out delicious and nutritious plant-based options (that now cover all classic foods), and the repeat rate of various plant-based categories have remained strong, demonstrating shopper loyalty and retention. In e-commerce, the annual growth rate for plant-based foods has now surpassed animal-based foods. Plant-based menu items are growing in foodservice outlets and not only are consumers coming back for more plant-based foods but operators are noting a significant increase in revenue from expanding their offerings. In short, we continue to see that plant-based foods ARE innovation and are driving growth and excitement.

While plant-based meat and milk still constitute the majority of sales, we see other categories gaining more traction in certain markets.The report uncovers opportunities for various plant-based categories such as dairy, cream cheese, sour cream and dips, baked goods, ready-to-drink beverages; and lays out data illuminating rapidly diversifying plant-based protein categories like tofu, eggs, and meals.

A few breakout highlights from the report:

-

In 2023, plant-based foods dollar sales reached $8.1 billion, growing 79% over the past five years. The household penetration rate and repeat rate remained strong at 62% and 81%, respectively.

-

From 2021 to 2023, a majority of plant-based categories grew in dollar sales, with plant-based creamers, plant-based ready-to-drink beverages, plant-based protein liquids and powders, plant-based baked goods, and plant-based eggs growing in both dollar sales and unit sales.

-

While the plant-based dollar share was nearly five times greater in the natural channel alone, certain plant-based categories such as yogurt, butter, and baked goods also grew rapidly across convenience stores.

-

When plant-based foods are easy for consumers to find with ample space and signage, both units and dollar sales outpace all other plant-based categories. As an example, in the case of plant-based milk, where sets are expansive, dollar sales are offsetting animal-based milk declines.Despite inflationary challenges, plant-based foods held firm at a 3.8% market share in total markets, and captured an impressive 18.4% in the natural market channel.

-

Although health remains a top motivator today, we are now seeing consumers seek out plant-based options for many other salient reasons, including taste/flavor preferences, the excitement of trying something new, and the desire to add more variety to their eating.

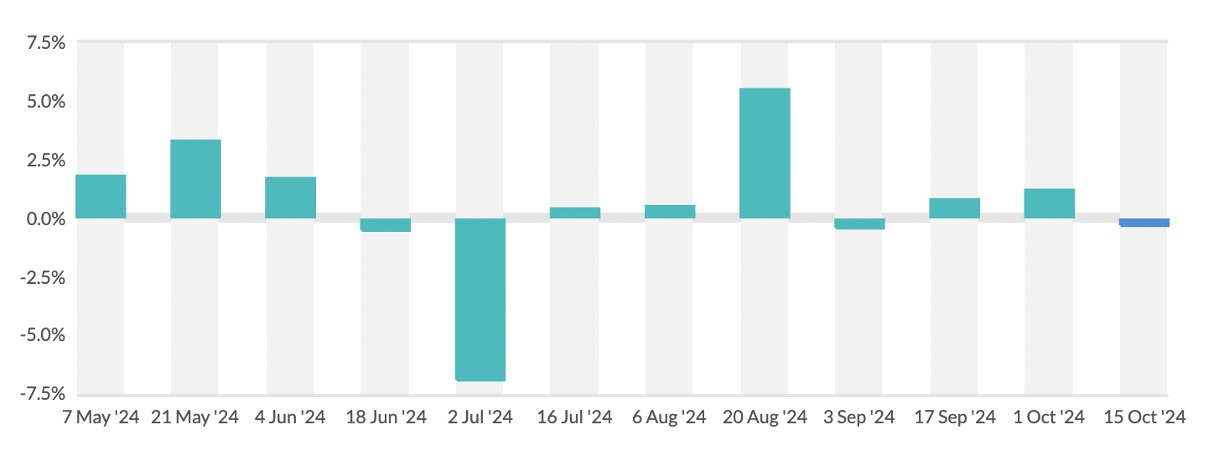

2023 Category Performance Reflects Inflation, Repeat Purchases

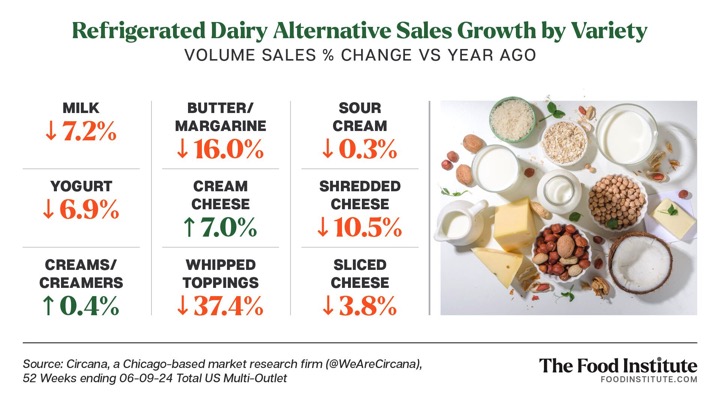

Per the Plant-Based Food Association’s (PBFA) 2023 State of the Marketplace report, U.S. retail dollar sales for plant-based milk reached $2.9 billion last year, while unit sales declined by 7.5%.

Furthermore, 44.1% of households purchased plant-based milk and 78.5% of households repeated their purchases, which suggests that most shoppers remain loyal to the category.

Innovation is a Key Category Driver

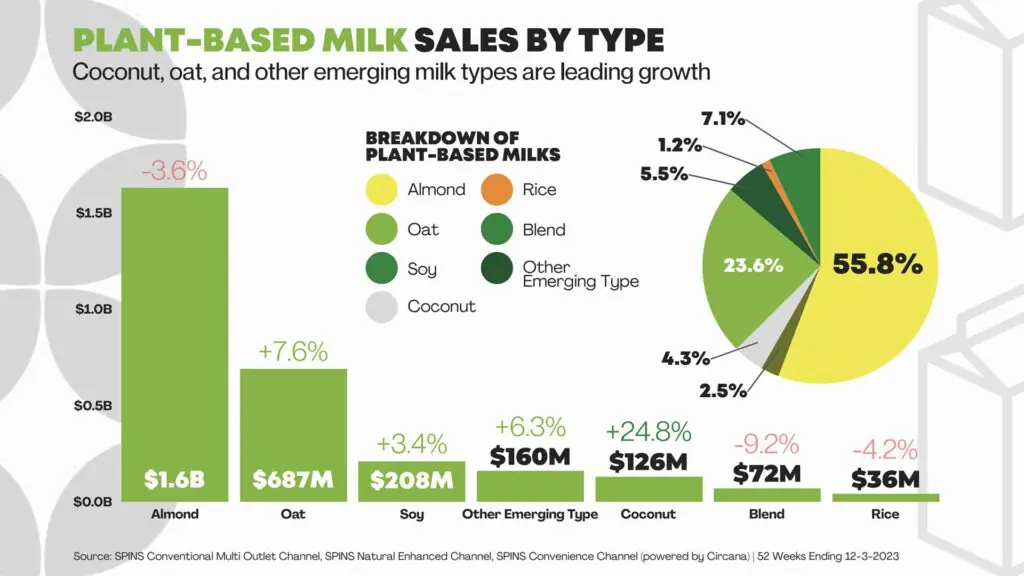

In terms of variety, almond milk continued to make up most sales of alternative milks in 2023, but oat, soy, and coconut saw the most dollar sales growth.

Other emerging milk types that grew in dollar sales included flax, cashew, and sunflower seed. Many such varieties were on display at the 2024 Specialty Coffee Expo.

“Plant-based consumers indicate that they have increased their plant-based dairy consumption due to more variety and novelty now available,” noted PBFA’s report authors. “As such, plant-based dairy products have the incredible opportunity to impact every eating occasion consumers experience, both inside and outside of the home.”

Plant-based milk producers continue to innovate and expand into new territory.

For instance, Israeli start-up Better Pulse recently unveiled a plant-based milk base made with black-eyed peas. When used as a milk alternative format, the company told Food Navigator that the base is creamy, sustainable, and delivers eight grams of protein per serving – at least three times more than most oat milk alternatives.

Oat, Cow’s Milk Mimics Grapple with Scrutiny

Per Innova Market Insights, consumers are still most open to trying plant-based milks made from familiar ingredients such as oat and coconut.

Some are turning their back on oat milk brands like Oatly and Planet Oat, however, as scrutiny grows over their nutritional value, low protein content, unpopular additives, and relatively high glycemic index, reported Yahoo Finance.

Alt-dairy beverages that are created to mimic the taste of cow’s milk are also struggling to capture market share.

In March 2024, Danone discontinued Silk Next Milk and So Delicious Wondermilk. The CPG giant debuted both offerings in late 2021 after replicating the traits in milk — its taste, nutritional components, molecular composition— but in plant form, reported Food Dive.

NotMilk, the mimic produced by unicorn Chilean food-tech company NotCo, is also dealing with the curdle of consumer malcontent. Per Yahoo Finance, some consumers say the product fails to recreate the taste of cow’s milk and they can detect certain unwanted flavors including pineapple and cabbage juices.