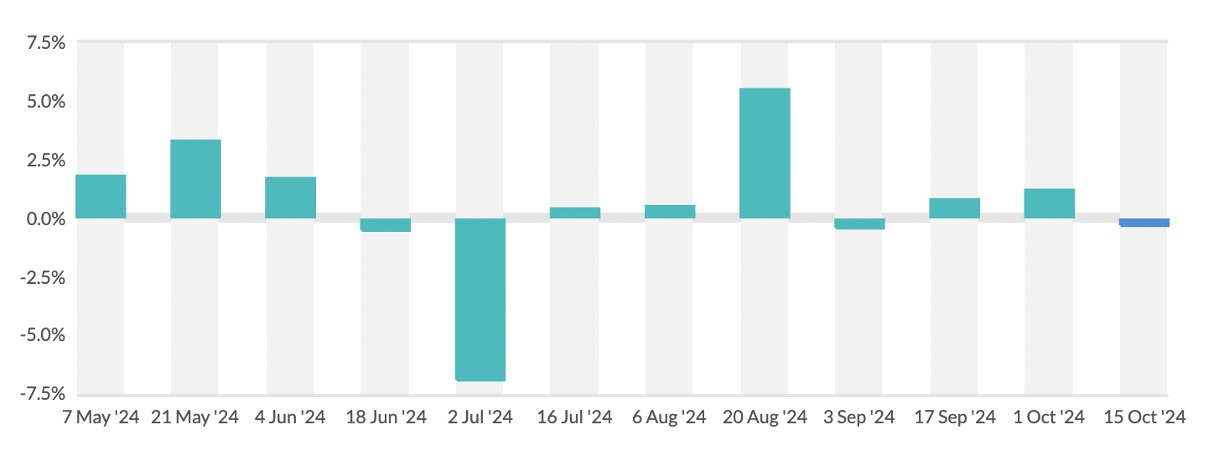

After a strong first quarter, the U.S. dairy economy looks promising for the remainder of 2024, but several factors could sway expectations quickly.

Record exports and increased domestic demand are positive, said Kathleen Noble Wolfley of Ever.Ag’s financial analysis team.

But large export markets, including China and Mexico, are becoming less predictable, and farmers have limited options for growth.

“Sometimes we can have really bullish things and really bearish things, and they combine to kind of be neutral,” said Colin Kadis, a dairy market adviser at Ever.Ag, during a June 21 webinar hosted by the Center for Dairy Excellence.

After a period of low cheese prices because of a lack of sale opportunities, exports have helped empty the saturated market. February, March and April all broke export records, Wolfley said.

So far this year, cheese exports are up by 75 million pounds over last year.

“That’s big volume that, in 2023, was looking for a home in the domestic market, putting pressure on prices, but in 2024, that’s product that’s finding a home in Mexico or South Korea or Japan,” Wolfley said.

Mexico has played a large part in export increases, buying 35% of U.S. cheese exports and almost 50% of milk powder.

But, in the last couple weeks, Mexico has elected a new president, and the peso’s value is taking a hit.

While exports have been up overall, sales to China have been down, which is unexpected and disappointing, Wolfley said.

Wolfley said she’s heard China may even be looking to export in the near future.

Many countries sell dairy products to China and may now be looking to shift to other markets, potentially competing with U.S. dairy.

Because of decreased shipping costs, some exporting countries may be able to beat the U.S. on price, Wolfley said.

“Mexico’s like the race car of exports,” Kadis said. “They come in, and they’re able to get some really good deals and help us on the short term.

“China feels like the semi-truck of exports. When China comes in, they have the potential to just clear the entire market and kind of change a year’s worth of pricing.”

Fortunately for the U.S., exports aren’t the only positive for cheese.

Domestic demand has increased in the last several weeks, both in restaurants and stores, thanks to big brands’ promotions, Wolfley said.

This comes amid consumer strain. Credit card debt and delinquencies are both up, and those looking for a job may have a harder time finding one than they would have in the past few years, Wolfley said.

It’s not all bad, though. For some (presumably affluent) individuals, travel and 401(k) contributions are also both up, Wolfley said.

Either way, cheese prices may climb if demand stays up, so promotions could stop, Wolfley said.

Dairy production is steady, but it’s a bit lower than the past, Wolfley said.

Bovine influenza A — avian influenza in cows — is causing “rolling brownouts,” Wolfley said.

The disease doesn’t knock out an area’s milk production, but production declines in infected herds by about 10%.

The trend is for production to drop for about two weeks and then climb back to normal over another two weeks, Kadis said.

“The market is already tight, and milk supply being a little tighter could make that situation even worse,” Wolfley said.