China is awash in unwanted milk as falling birth rates and cost-conscious consumers have cut demand even as dairy farms expanded in recent years, forcing smaller farmers out of business and squeezing shipments into the world’s top importer.

China’s milk surplus illustrates the unintended consequences of Beijing’s food security-driven efforts to boost its dairy sector by touting consumption and encouraging expansion. High costs and the legacy of an adulteration scandal in 2008 that killed at least six children and hospitalized thousands, meanwhile, limit its export opportunities.

Weighed down by a sluggish economy that has weakened demand for higher-priced foods like cheese, cream and butter, as well as an aging population, Chinese milk consumption fell from 14.4 kg per capita in 2021 to 12.4 kg in 2022, the last year for which data from China’s statistics bureau is available.

At the same time, milk output in China, the world’s third-largest producer, surged to nearly 42 million tons last year, from 30.39 million tons in 2017, surpassing Beijing’s 2025 target of 41 million tons.

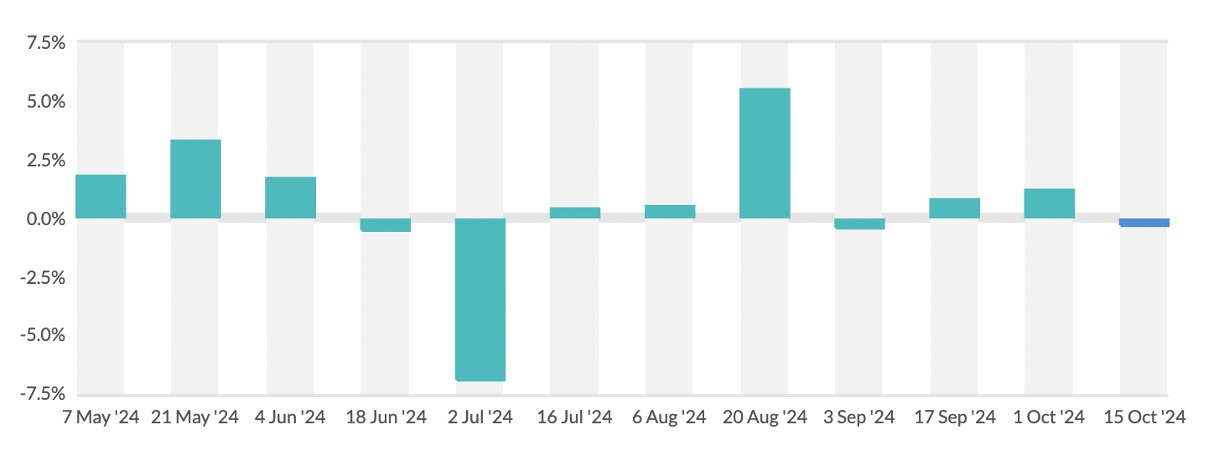

Chinese milk prices have fallen since 2022 to below the average production cost of around 3.8 yuan ($0.5352) per kg, causing many loss-making farms to shut and other farms to shrink their herds by selling cattle for beef – another oversupplied market.

Modern Dairy , one of China’s major producers, reported a halving of its dairy cattle herd in the first half of this year, posting a net loss of 207 million yuan ($29.07 million).

“Dairy farming companies are losing money on selling milk and selling meat,” said Li Yifan, Head of Dairy (Asia) at commodity financial services firm StoneX.

Chinese dairy imports, mainly from New Zealand, the Netherlands, and Germany, dropped 13% year-on-year to 1.75 million metric tons in the first eight months of this year. Milk powder, the top dairy import, was down 21% to 620,000 tons, China customs data shows.