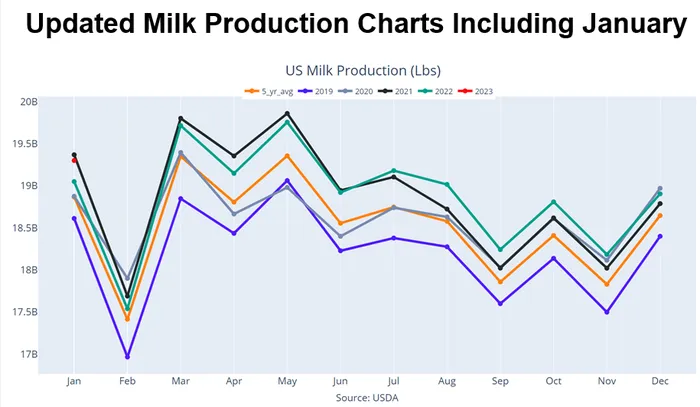

On Wednesday afternoon, USDA released the most recent U.S. milk production report. Production continues to increase as the report stated that, “Milk production in the 24 major States during January totaled 18.5 billion pounds, up 1.5% from January 2022.”

Production has now been up on a year-over-year basis for seven months in a row!

The report went on to say, “Production per cow in the 24 major states averaged 2,069 pounds for January, 18 pounds above January 2022. The number of milk cows on farms in the 24 major states was 8.93 million head, 51,000 head more than January 2022, and 9,000 head more than December 2022.” It is interesting to note that Wisconsin saw 1.60% growth from last year, Michigan added 2.10%, and Iowa milk production grew 7.40%.

With production being so plentiful, that may keep a lid on any meaningful Class III milk futures rally attempts for the time being. However, the market prices continue to be well supported overall thanks to domestic and export demand for dairy products.

Global demand

Tuesday morning’s Global Dairy Trade Auction saw GDT cheddar close over 1% higher, near $2.31/lb. This welcome news helped to incentivize buying in the spot trade later that morning in which the block/barrel average leaped 5.75 cents to $1.77125/lb.

Also on a global perspective, according to the most recent United States Dairy Exports report, showed that in December all U.S. dairy exports totaled 216,699 metric tons, which was up 14% from the same month last year.

On a year-over-year basis, whey exports were up 20% and cheese exports were up 16% from last year. Exports continue to be a supportive factor for the dairy complex. The next dairy export report will be released on March 8, 2023.

Let’s talk about cheese

Cheese production is increasing, with demand remaining firm. U.S. Cheese Production in December totaled 1.20 billion pounds, which was up 2.20% from a year ago and up 4.20% from November. Production overall has been trending higher, likely tied to the overall increase in milk production.

Monthly Cheese in Cold Storage at the end of December 2022 totaled 1.445 billion pounds. This was up 1% from December 2021 and down 1% from the month prior. By comparison, the amount of cheese in storage in December 2021 was 1.441 billion pounds. The next cold storage report will be on Friday, February 24, 2023.

Class IV product demand

If you are new to the term “Class IV” milk, this is milk used to produce butter, any milk product in dry form and evaporated or sweetened condensed milk. U.S. butter demand is strong, along with the exports of U.S. butter to the world.

U.S. butter production during December totaled 187 million pounds, which was up 3.90% from December 2021 and is up 9.40% from the prior month. The high butter prices in 2022 seem to be influencing an uptick in production as it hung above the 5-year average for the last three months of the year. The next production report will be March 3, 2023

Butter exports in 2022 totaled 144.1 million pounds, up nearly 50 percent from 2021 and the highest level since 2013. Which countries are buying our butter? Top buyers last year were Canada (up 105%), South Korea (up 209%), and Mexico (up 97%).

Outlook head

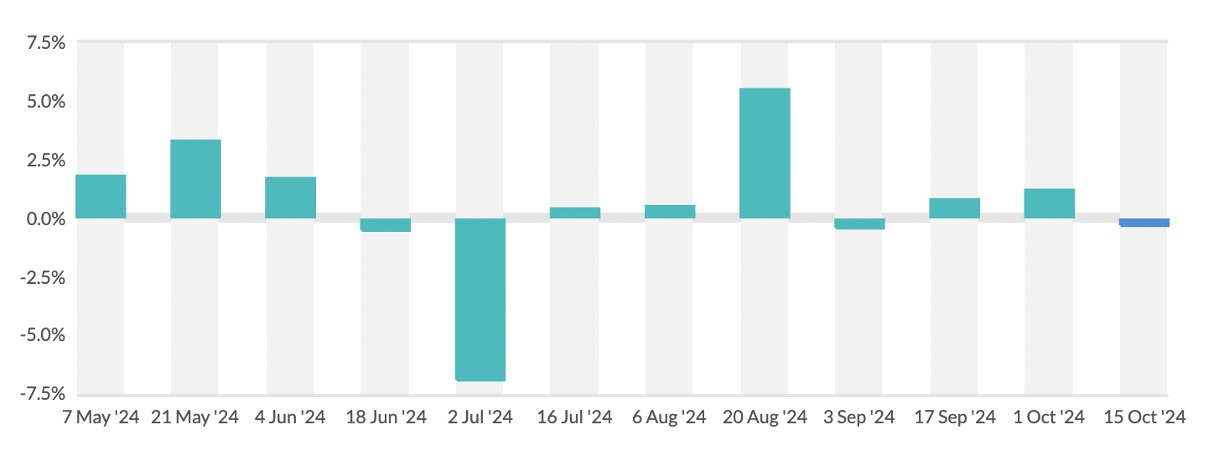

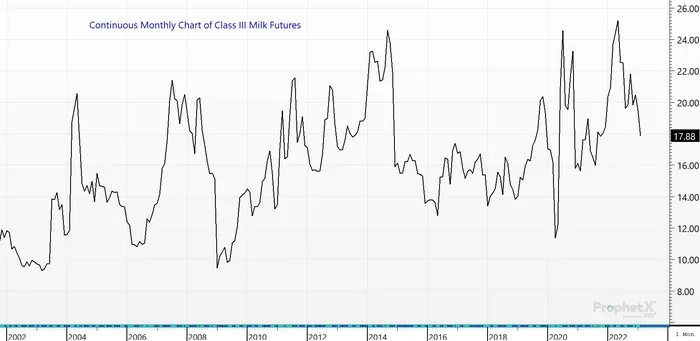

Looking at a continuous monthly price chart of Class III milk futures, you can see how current prices are trading in in the middle of the range for the past two decades.

Going forward, if domestic demand and export demand can remain strong, that will help to keep milk prices firm, however the overall trend in actual milk production is on the increase, which potentially could flood the market with oversupply of dairy products. It will be interesting to see how the coming months unfold for the dairy industry.